China – A study in volatility, country allocation and performance

How does one decide on the geographical distribution of their investments in his/her portfolio?

There are several default options. If you are a professional fund manager or asset allocator, the index you are measured against will largely determine the geographical spread of the portfolio. For many individuals, their familiarity with local/regional stocks makes buying local stocks their default mode for deciding what stocks to buy. Both these methods have their pros and cons. The latter practice of sticking to the familiar is a double-edged sword; the home bias for a US investor was better rewarded than that of a Japanese investor in the past 30 years.

How then should an individual invest if he is not constrained either by an index or his home bias? How does Pinnacle allocate investment dollars? The simple answer is that we go to where the opportunities are.

- That means we are global investors, not restricting ourselves to any particular market, but availing ourselves of the best opportunities in the world.

- Neither are we limited by country allocation. Institutional investors may be limited by how much their fund may allocate to a country or region as dictated by their fund’s mandate, we go where the opportunities and returns are to be found

A bottom-up approach, that seeks to find the most attractive investments on quality and valuation has been proven by practitioners such as Warren Buffett, Fundsmith, Baillie Gifford to be effective in delivering performance. But whilst building a portfolio from bottoms up without a benchmark constraint is intuitively appealing and can potentially lead to long-term outperformance in the long term, in the short term this flexibility is a double-edged sword that greatly increases the chance of outperformance or underperformance.

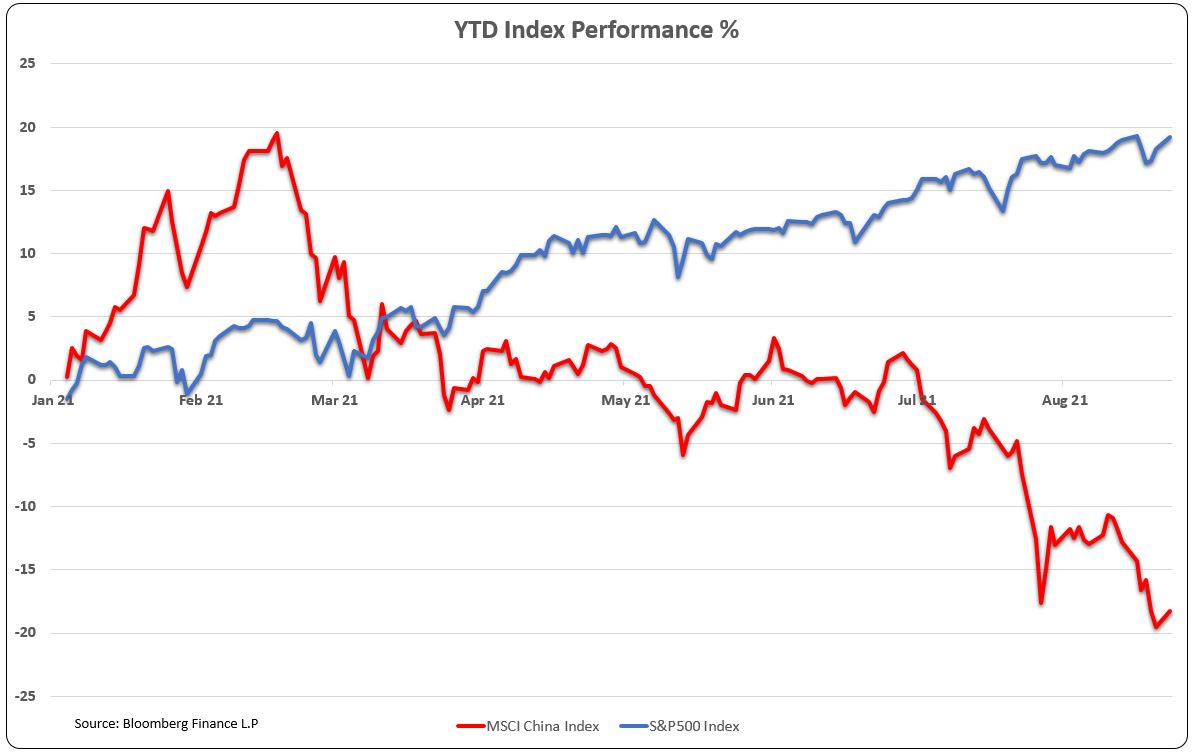

The current divergent performance of the US and China illustrates how wealth managers committed to stock-picking, being unconstrained by benchmark have to sit through a period of underperformance when their underlying investments are out of fashion.

The underperformance of Chinese stocks is made even more glaring in that Chinese stocks are given only a very small allocation in international equity indices. Should we limit Chinese exposure to under 5% as dictated by the MSCI All Country Index? Given the size and growth rate of their economy, would there be more opportunities in China than is suggested by MSCI’s 4.2% allocation. Blackrock recently in a research article recommended that China’s allocation in global indices be increased by three times, befitting the size of its economy and giving recognition to a market that has come of age and is no longer an emerging market.

In the short run, how one had responded to these questions would probably have been the major determinant of the portfolio’s performance. In the long run, however, our conviction is all that matters is that investors will be rewarded for picking good quality growth companies that are managed by shareholder-friendly managers bought at a reasonable price.

24 Aug 2021